INFINOX Trading Platform Analysis 2025: Comprehensive Safety & Performance Review

Established in 2009 with an unwavering commitment to trader empowerment, INFINOX stands as a premier multi-regulated FX & CFD brokerage serving clients across 15 countries. The platform delivers competitive market access spanning forex, commodities, indices, equities, and futures through cutting-edge technology and transparent operations. With a proven track record of client-focused service and stringent safety protocols, INFINOX has earned recognition as a preferred destination for both retail and professional traders seeking comprehensive market exposure.

INFINOX at a Glance: Key Metrics & Performance

|

Category |

INFINOX Specifications |

Market Standard |

|

Establishment |

2009 |

N/A |

|

Entry Requirements |

From 0.01 lots |

$100-250 |

|

Market Coverage |

900 assets |

200-500 |

|

Technology Stack |

MT4, MT5, IX Social, IX SYNC |

MT4/MT5 Basic |

|

Cost Structure |

Competitive pricing |

Variable |

|

Capital Efficiency |

Up to 1:1000 |

Up to 1:500 |

|

Client Satisfaction |

4.7/5 (Excellent) |

3.5-4.0/5 |

|

Market Presence |

15 jurisdictions |

Limited |

|

Regulatory Framework |

Multi-tier oversight |

Single authority |

This detailed snapshot showcases INFINOX's dedication to delivering comprehensive trading solutions with institutional-grade infrastructure and global reach.

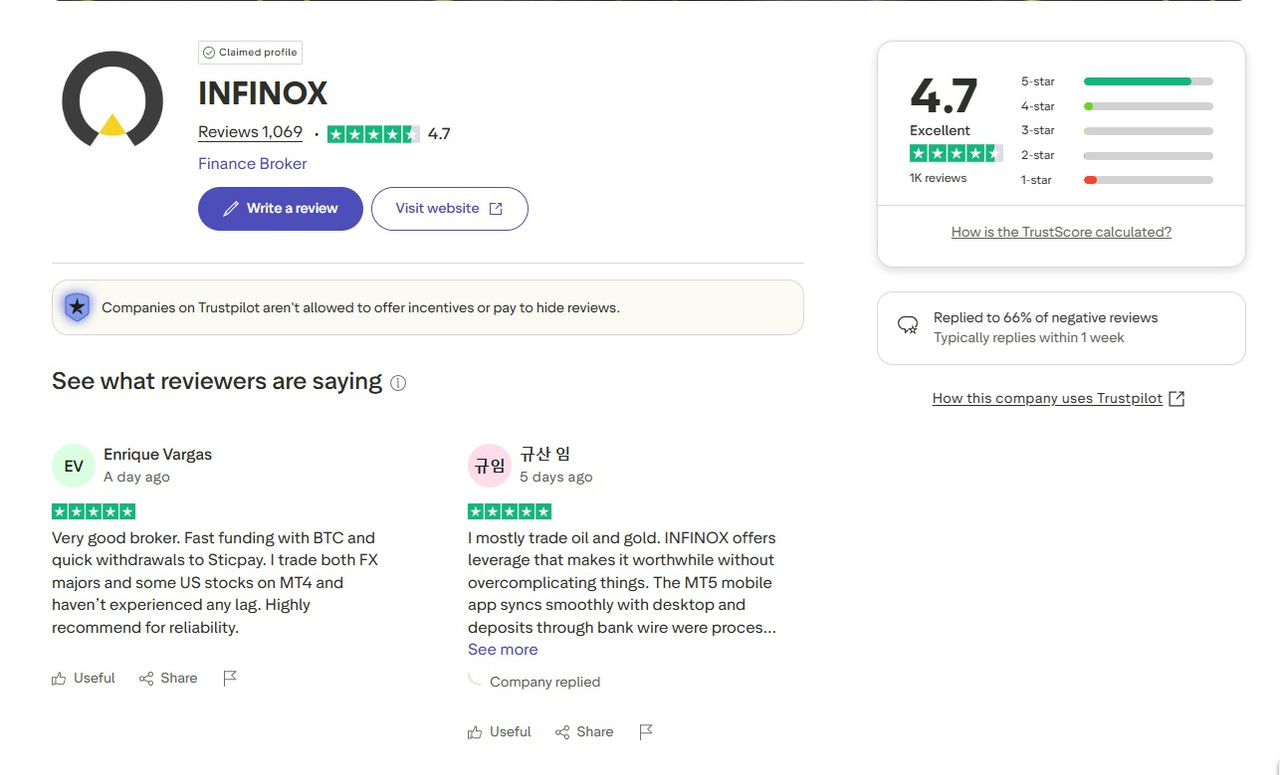

Client Satisfaction Analysis: Trustpilot Performance Review

INFINOX demonstrates exceptional client satisfaction with an "Excellent" 4.7/5 Trustpilot rating across 1,069 verified reviews. This performance substantially exceeds typical forex industry benchmarks, which commonly range between 3.5-4.0 stars.

Caption: Traders rate INFINOX 4.7 on Trustpilot, highlighting fast execution, funding, and customer support.

Customer feedback distribution reveals overwhelmingly positive sentiment:

- Outstanding (5 stars): Dominant review category

- Very Good (4 stars): Strong supporting segment

- Satisfactory (3 stars): Minimal representation

- Below Average (2 stars): Negligible presence

- Unsatisfactory (1 star): Limited occurrences

Client Commendations: Most Valued Features

Recent verified testimonials consistently emphasize:

- System Stability: "The MT5 platform runs super smooth and spreads are tight on my ECN account"

- Execution Excellence: "I trade both FX majors and some US stocks on MT4 and haven't experienced any lag"

- Support Quality: "The assistance is amazing, very fast and very friendly"

- Learning Resources: "Honestly impressed with their IX Education Hub. As a beginner I learned the basics of forex, indices, and commodities"

- Transaction Speed: "Fast funding with BTC and quick withdrawals to Sticpay"

Enhancement Opportunities

Client feedback identifies potential improvements:

- Expansion of exotic currency pair offerings

- Enhanced communication protocols for complex cases

- Broader cryptocurrency asset selection

INFINOX demonstrates proactive client engagement, responding to 66% of critical reviews within one week, reflecting their commitment to continuous service enhancement and issue resolution.

Corporate Foundation & Regulatory Compliance

INFINOX operates through an extensive global infrastructure spanning Latin America, MENA, Europe, and Asia regions. Since inception in 2009, the firm has achieved notable milestones including strategic partnerships with elite organizations such as the BWT Alpine F1® Team, demonstrating their alignment with precision and performance excellence.

The brokerage's regulatory architecture delivers comprehensive client safeguarding through multiple authoritative jurisdictions. Market analysis indicates that diversified regulatory oversight significantly enhances trader protection and operational integrity, which INFINOX provides through rigorous compliance standards.

Regulatory Authorization Matrix

|

Jurisdiction |

Oversight Body |

Authorization Type |

Protection Measures |

|

Bahamas |

Securities Commission of the Bahamas (SCB) |

Comprehensive License |

Segregated client funds |

|

Mauritius |

Financial Services Commission (FSC) |

Investment Services License |

Regulatory monitoring |

|

United Kingdom |

Financial Conduct Authority (FCA) |

Full Authorization |

FSCS coverage |

INFINOX's diversified regulatory foundation ensures comprehensive account protection through segregated fund requirements, supplemented by exceptional insurance coverage extending to USD 1,000,000 per eligible claimant via their enhanced protection policy, valid through May 2026. This protection level significantly surpasses standard industry provisions and exemplifies the broker's commitment to client asset security.

Trading Account Structures & Options

INFINOX provides versatile account configurations tailored for diverse trading approaches, from novice investors to institutional operations. The platform delivers both Electronic Communication Network (ECN) and Straight Through Processing (STP) solutions, featuring deep market liquidity, advanced execution technology, and comprehensive analytical tools.

Account Type Comparison: STP vs ECN Performance

|

Specification |

STP Solution |

ECN Solution |

|

Pricing Model |

From 0.9 pips |

From 0.2 pips |

|

Capital Leverage |

Up to 1:1000 |

Up to 1:1000 |

|

Transaction Fees |

0 GBP/EUR/USD/AUD |

From 7 GBP/EUR/USD/AUD |

|

Position Size |

0.01 lots minimum |

0.01 lots minimum |

|

Account Status |

Primary eligible |

Secondary option |

|

Portfolio Management |

Multiple accounts |

Multiple accounts |

STP Solutions deliver zero-commission trading environments with competitive spread structures, particularly suitable for position traders and those preferring simplified cost calculations without per-transaction charges.

ECN Solutions provide institutional-quality execution with spreads from 0.2 pips, balanced by commission structures starting at 7 GBP/EUR/USD/AUD per standard lot. This framework typically favors scalping strategies and high-frequency trading approaches prioritizing minimal spreads and direct market connectivity.

Ownership Structure Flexibility

INFINOX supports multiple ownership configurations to accommodate varied client requirements:

Individual Portfolios: Designed for sole ownership with complete account authority. This structure suits independent traders preferring full control over trading strategies and account administration.

Joint Portfolios: Facilitate shared access through collaborative agreements, ideal for partnerships or family investment strategies where multiple parties require trading authority and decision-making participation.

Corporate Portfolios: Structured for business entities including investment funds, trading firms, and corporate treasuries requiring institutional-grade service delivery and regulatory compliance frameworks.

Registration & Onboarding Process

INFINOX has optimized their client onboarding into three streamlined phases, ensuring accessibility across all experience levels. The initial application process requires minimal time investment while maintaining regulatory compliance standards.

- Application Submission: Complete the streamlined online registration and verify account credentials

- Account Funding: Transfer funds to your designated trading account for immediate activation

- Market Access: Capitalize on trading opportunities across 900 available instruments

The authentication process maintains international KYC compliance standards while prioritizing operational efficiency. Standard account approvals typically process within 24-48 hours, enabling traders to respond to market opportunities promptly. Practice accounts provide risk-free trading environments, allowing new participants to master platform functionality and develop market familiarity before live trading.

Technology Infrastructure & Trading Platforms

INFINOX delivers cutting-edge trading technology designed for both entry-level and professional market participants. Each platform solution offers specialized capabilities optimized for different trading methodologies and user preferences.

MetaTrader 4 Integration

MT4 maintains its position as the fundamental forex trading solution, providing sophisticated charting systems with 30 integrated technical indicators. The platform enables automated trading through Expert Advisor (EA) integration, facilitating systematic analysis and trade execution. Core capabilities include:

- Advanced Analytics: MT4 delivers comprehensive charting tools and analytical instruments supporting complex trading methodologies

- Technical Intelligence: 30 integrated technical indicators, analytical frameworks for precise entry/exit identification, 4 pending order categories, 9 timeframe options

- Instant Execution: Single-click trade execution without secondary confirmations, optimizing order processing speed

- Systematic Trading: Expert Advisor compatibility enabling automated analytical processes and trade management

MetaTrader 5 Enhancement

The sophisticated MT5 platform extends beyond forex into multi-asset trading environments, incorporating 38 built-in technical indicators and enhanced analytical frameworks. Notable advancements include:

- Execution Flexibility: Netting and hedging account systems with instant, request, market, and exchange execution capabilities

- Enhanced Analytics: 38 integrated technical indicators, market depth visualization, hedging/netting options, 6 pending order types, 21 timeframe selections

- Market Intelligence: Integrated economic calendar providing global macroeconomic data and news analysis impacting trading decisions

- Cloud Computing: Virtual Private Server (VPS) integration ensuring continuous EA operation and minimal latency execution through remote server infrastructure

Proprietary Solutions: IX Social & IX SYNC

These innovative platforms demonstrate INFINOX's technological advancement, delivering integrated social trading capabilities and synchronized trading experiences across multiple device platforms.

Market Coverage & Asset Classification

INFINOX provides comprehensive access to 900 trading instruments across diverse asset categories, enabling extensive portfolio diversification and strategic opportunity capture.

Foreign Exchange Markets

The forex selection encompasses major, minor, and exotic currency combinations with competitive pricing structures. Maximum leverage of 1:1000 remains available for eligible non-EU clients, while EU participants benefit from ESMA-compliant leverage restrictions ensuring responsible trading practices.

Commodity & Precious Metals Trading

Hard and soft commodity access includes precious metals (gold, silver, platinum, palladium), energy derivatives (crude oil, natural gas), and agricultural contracts (wheat, corn, coffee). These instruments provide portfolio diversification benefits and inflation protection strategies.

Equity CFDs & Index Products

Global equity market exposure through CFD structures covers major indices including S&P 500, DAX 40, and FTSE 100, complemented by individual stock CFDs representing leading corporations across technology, pharmaceutical, and aviation sectors.

Futures Contract Access

Selected futures instruments span commodities, indices, and currency categories, providing professional traders with additional strategic capabilities and comprehensive risk management tools.

Cost Structure & Fee Analysis

INFINOX maintains competitive pricing across all account categories. The platform operates dual pricing models - spread-based and commission-based structures - enabling traders to select cost frameworks aligned with their trading frequency and strategy requirements.

Spread-only accounts provide straightforward pricing without additional per-trade charges, while commission-based accounts typically offer reduced spreads offset by per-lot fees. Historical data analysis suggests high-volume traders often benefit from commission structures, while occasional traders prefer spread-only arrangements.

Overnight financing rates apply daily to held positions, with specific calculations varying by instrument and prevailing market conditions. The broker maintains complete fee transparency through published rate schedules, enabling accurate pre-trade cost calculations.

Client Support Infrastructure

INFINOX's premium service commitment manifests through comprehensive 24/7 support infrastructure. Regional teams deliver assistance across 15 languages, ensuring traders receive native-language support regardless of geographic location.

Available communication channels include:

- Immediate live chat assistance

- Detailed email inquiry support

- Direct telephone access through local numbers

- Instant messaging platform integration

Response efficiency remains consistently high, with live chat typically connecting users to qualified representatives immediately. Support team expertise extends beyond basic platform assistance to encompass trading guidance and market analysis insights.

Educational Resources & Market Intelligence

INFINOX demonstrates substantial commitment to trader development through comprehensive educational offerings available to all clients. The learning ecosystem includes:

- Video Education Series: Professional-led instructional content across multiple languages covering fundamental through advanced concepts

- Daily Market Analysis: Expert commentary and trading opportunity identification from seasoned market professionals

- Live Market Commentary: Real-time analysis and trade idea generation

- Comprehensive Guides: Detailed educational materials covering technical and fundamental analysis methodologies

- Community Platform: Interactive networking environment for trader collaboration and insight sharing

These resources serve traders across all proficiency levels, from beginners acquiring foundational knowledge to advanced practitioners seeking sophisticated market analysis.

Security Framework & Fund Protection

Client asset security represents a fundamental pillar of INFINOX's operational structure. Segregated client account protocols ensure trading capital remains separate from corporate operational funds, providing protection aligned with regulatory mandates.

The broker's enhanced insurance coverage delivers protection up to USD 1,000,000 per eligible claimant, substantially exceeding standard industry protection levels. This coverage became effective June 1, 2024, continuing through May 31, 2026, providing additional confidence for client deposits.

Negative balance protection ensures retail clients cannot incur losses exceeding their account balance, even during extreme market volatility periods. This protection aligns with global regulatory standards and demonstrates INFINOX's commitment to responsible trading practices.

Industry Recognition & Awards

INFINOX's service excellence has earned recognition through numerous 2025 industry accolades, including:

- Outstanding IB/Affiliate Programme - Money Expo Mexico 2025

- Premier Global Broker 2025 - Money Expo Colombia 2025

- Most Trusted Multi-asset Platform Global 2025 - World Business Outlook

- Most Innovative Platform - Global Brand Frontier Awards 2025

- Premier Forex Broker Global 2025 - Brand Review Magazine

- Leading CFD Provider LATAM 2025 - Brand Review Magazine

These honors reflect consistent excellence across innovation, trustworthiness, and service delivery categories.

Strategic Alliances

Caption: INFINOX partners with the BWT Alpine F1 Team, combining innovation in finance and motorsport.

The collaboration with BWT Alpine F1® Team transcends traditional sponsorship arrangements, embodying shared principles of precision, performance optimization, and boundary expansion. Both organizations function within intensely competitive environments demanding meticulous planning, adaptive strategies, and relentless pursuit of excellence.

This partnership exemplifies INFINOX's commitment to associating with world-class entities sharing comparable values of innovation and performance distinction.

Strengths & Limitations Assessment

Primary Advantages

- Multi-jurisdictional regulatory oversight ensuring comprehensive client protection

- Extensive asset selection featuring 900 tradable instruments

- Sophisticated platform options including MT4, MT5, and proprietary technologies

- Competitive leverage reaching 1:1000 for qualified clients

- Round-the-clock premium support across 15 languages

- Comprehensive educational infrastructure and research capabilities

- Enhanced insurance coverage up to USD 1,000,000 per claimant

- Global operational presence with localized support teams

- Multiple industry awards recognizing service excellence

- Flexible account structures accommodating various trading approaches

- Zero-commission STP accounts and low-spread ECN alternatives

Areas for Enhancement

- EU leverage limitations due to ESMA regulatory requirements

- Limited cryptocurrency selection compared to specialized digital asset brokers

- Platform complexity may initially challenge novice traders

Final Assessment: INFINOX Value Proposition

INFINOX demonstrates exceptional dedication to delivering comprehensive trading solutions supported by robust regulatory oversight and premium client service delivery. The broker's extensive instrument selection, competitive trading conditions, and award-winning platform technology make it suitable for traders across all experience categories.

The integration of multi-jurisdictional regulation, innovative technology infrastructure, and comprehensive educational resources creates a trading environment prioritizing client success. Historical performance metrics and industry recognition validate INFINOX's position as a leading global brokerage provider.

For traders seeking a reliable, comprehensively regulated broker offering extensive market access and professional-grade tools, INFINOX presents a compelling proposition. The broker's fee transparency, comprehensive client protection measures, and commitment to continuous innovation make it particularly appropriate for both active traders and long-term investment strategies. INFINOX is a regulated broker that prioritizes client achievement through innovation, transparency, and exceptional service standards.

Frequently Asked Questions: INFINOX

Does INFINOX maintain proper regulation? Affirmative, INFINOX holds multiple authorizations including FSC (Mauritius), SCB (Bahamas), and FCA (United Kingdom), providing comprehensive regulatory oversight and client protection frameworks.

What are the minimum deposit requirements? INFINOX provides flexible account access with positions available from 0.01 lots, accommodating various capital investment levels.

Are US residents eligible for INFINOX services? Regulatory restrictions may apply for US residents. Potential clients should confirm eligibility during the account registration process.

How are withdrawals processed from INFINOX? Withdrawals process through identical methods used for deposits, with most requests completing within standard timeframes based on the selected payment method.

Is INFINOX suitable for beginning traders? Yes, INFINOX provides comprehensive educational resources, practice accounts, and user-friendly platforms appropriate for traders across all experience levels.